Get insights into the type of problems I tackle by exploring a selection

of my own data science experiences. Each project relies heavily on the

indicated technique.

You will notice that many topics leverage more than one modeling strategy,

and that's fine. In practice you have to understand the problem and choose

your toolset accordingly. Models are just tools you use to help solve the

problem. As such you need to be familiar and comfortable with a variety

of methodologies.

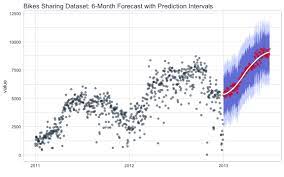

At Cargill I led the design and deployment of Kitchen Blueprint,

an innovative application within the proprietary packaged

food division, focusing on serving restaurant partners.

Kitchen Blueprint utilizes a sophisticated forecasting algorithm

to predict ingredient consumption into the near future for

individual restaurants. Leveraging these forecasts, and real-time

inventory information, the application recommends optimal

ingredient ordering quantities, effectively reducing food waste

by approximately 30%.

Scalability posed a significant challenge for this project, as we

were required to run hundreds of individual ingredient-level

forecasts per location. To address this, I developed a fully automatic

custom time-series module I named FIFE (Finite Interval Forecasting).

This surpasses standard AutoML functionality by similarly enabling

auto-selection of models and hyperparameters, but also including

robust edge-case handling and greater intelligence in model selection.

This advanced forecasting process runs on the Azure cloud platform.

As I lead the expansion of Kitchen Blueprint to accommodate new

edge-cases and business needs, due to FIFE the solution remains

adaptable. Kitchen Blueprint continues to demonstrate its

effectiveness in mitigating food waste, enhancing profitability,

and promoting sustainability across our restaurant partners.

Recommendation Engine

Personalized Playlist Generation

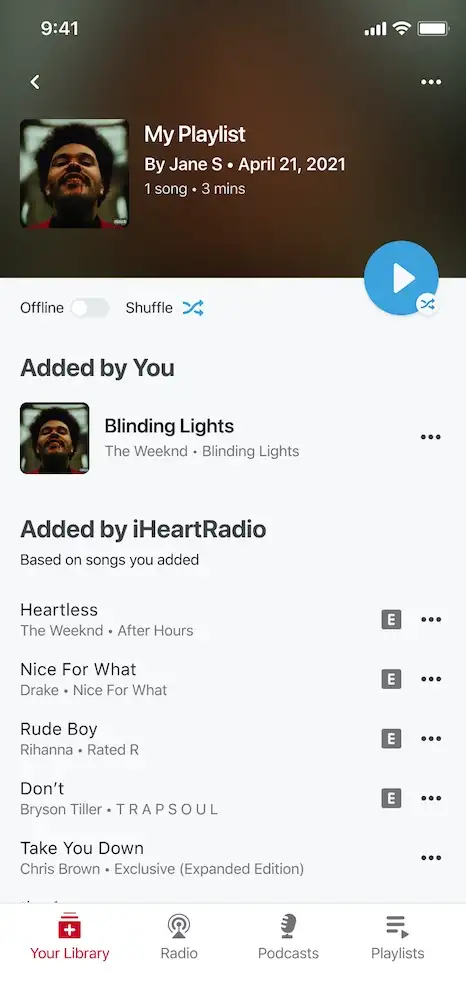

At iHeartRadio, I led the back-end execution of the flagship

product, 'My Playlist,' which is a core feature on the app.

The algorithm I designed and deployed generates personalized

music playlists based on a small handful of user-selected songs.

It recommends additional songs to the user to help them further

enhance their custom playlist, and if too few songs were selected

to fill out the playlist entirely it will automatically populate

these on the user's behalf.

Named the 'Most Popular New Feature of 2021', the product has been

a resounding success, significantly increasing both revenue and user

engagement. Analysis shows that users spend significantly more time

listening to their own personalized playlists than for similar

pre-curated content on the app.

So, how does this work? Well, the recommendation system employs a

combination of Matrix Factorization, Bayesian Inference, and

statistical measures to find similar tracks to those manually

entered into the playlist. However, this goes beyond simple similarity

matching and incorporates factors like song enjoyment, estimated

revenue based on user listening time, and track royalties paid by

iHeartRadio.

But just because a song is similar does not mean that the

listener will enjoy it. To ensure track quality, I designed a

custom star-ranking system, relying heavily on Bayesian re-ranking,

to judge the 'enjoyability' of tracks. The details of this system

are outlined in the iHeartRadio Tech Blog I link to at the end

of this section.

Finally, we come to ordering of tracks within the playlist.

Optimizing the track order posed challenges due to balancing user

engagement with royalty considerations. I devised a graph-based

reinforcement learning algorithm to optimize the ordering of

the tracks, ensuring an enjoyable listening experience while

adhering to licensing rules and reducing costs.

For a comprehensive exploration over the technical aspects of

the star-ranking system discussed above please refer to my

iHeartRadio Tech Blog

(Link Here).

Reinforcement Learning

Dynamic Sales Plan Creation

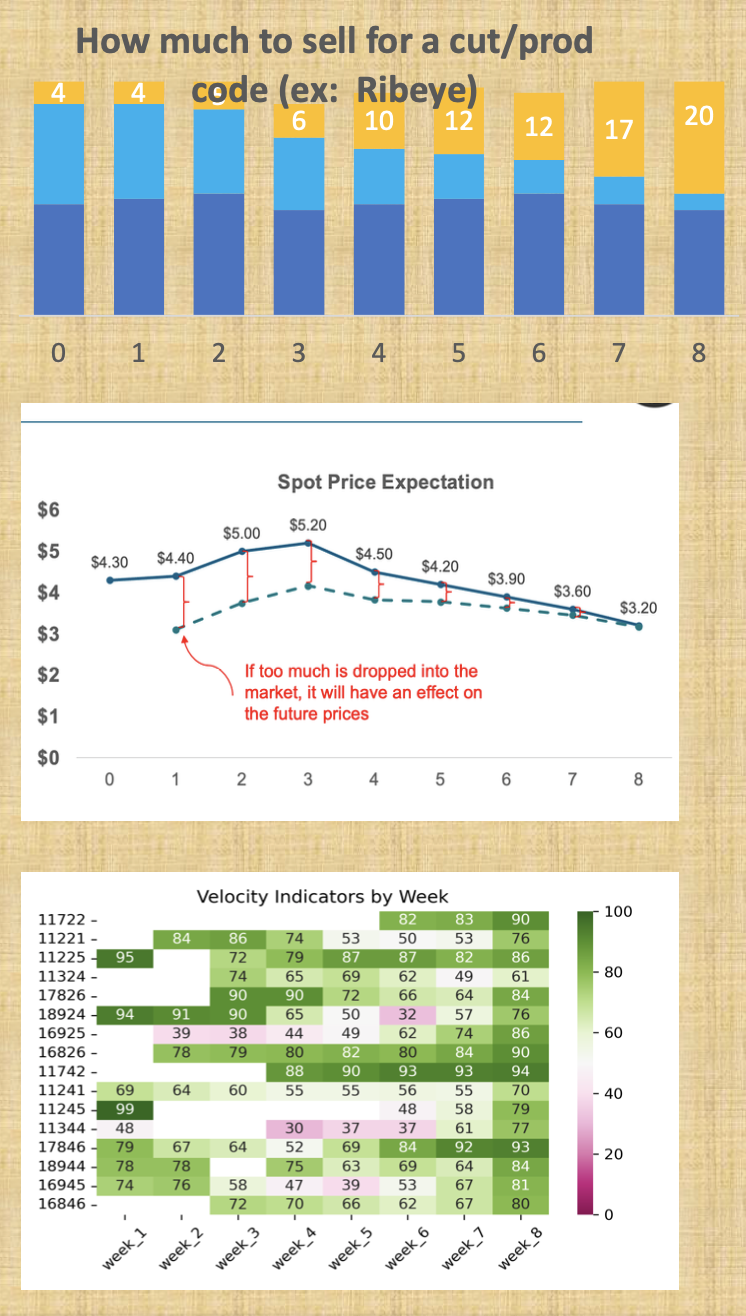

This project provides a solution to a pressing challenge faced

by the protein arm at Cargill. They required detailed insights

the future of the ever-evolving boxed-beef market. You see, sales

contracts can be signed months before shipment, but the USDA only

provides signed contract prices for the first 3 weeks into the

future. Hence, for the medium term (4-8 weeks out) the business

is essentially blind.

The business already had an implemented solution, but it was

known by them to be intractable, requiring days to run, and even

then only providing a fraction of the insights they required.

I considered whether this problem was best solved as an optimization

problem, but ultimately, decided to reimagine the project using a

probabilistic approach.

This solution combines forecasting future prices based on expected

market conditions, simulating hundreds of possible future

perturbations, and reinforcement earning to generate a recommended

sales "velocity" for the upcoming 8 weeks. These insights are then

used to guide sales managers on how much of their existing stock

they should target to move each week, where higher "velocities"

indicate weeks where they should be more willing to sell.

This is a multi-step process. The first portion forecasts the

expected prices assuming nothing critical occurs in the market.

The second calculates the price elasticity based certain factors.

The third takes all inputs and simulates thousands of possible

scenarios, ultimately providing the sales plan belonging to

the statistically most profitable outcome. In practice this

works quite well and has been estimated by the protein arm to

increase profits by around one million dollars.

Regression

AI Pricing and Promotion Decomposition

The meat-based protein arm of Cargill had a problem. When they

made decisions to change product prices, or run product promotions,

they were no longer seeing the same success they used to. In

fact, they were starting to see market-share fall. What they

needed was a data-driven product.

I developed a sophisticated solution to inform the business

of the optimal grocery store pricing strategy as well as the

expected impact for different types of promotions the stores

could run. By using this the business can simulate the expected

impact of any decision they make, or decisions made by key

competitors.

To do this I created an advanced regression model, based on

econometric principles, which forecasts the volume sold for

that each week based on a myriad of factors. The "secret sauce"

is that most of these factors represent an important lever

or dial the business or their competitor's control.

The simulation aspect of this solution leverages the extracted

elasticity for our own price changes, the elasticity for

competitors price changes on the sale of our products, the

boost in sales we receive from a particular type of promotion,

and many others.

Deployment of this solution, and incorporating it into the

toolset used by the sales team, drove a significant increase

in profits and I am currently overseeing the scaling of this

into additional stores. I designed this to be a platform,

and not a set of standalone solutions. This conscious

architectural design choice means that only relatively small

alterations are needed for moving it into new locations.

Classification

Financial Product Forecasting Solution

Cargill purchases produce from farmers in a multitude of ways.

For example, farmers can show up unannounced and sell their

crop on-the-spot at whatever the current market-price is,

they can negotiate a static price months ahead of time, or

choose other complex options. During these negotiations farmers

also provide an estimate for the amount to be delivered, but based

on many factors this is also subject to change. In a situation

like this, the more insight Cargill has at their disposal the better

they can negotiate and plan targeted marketing strategies.

After discussing the details at length with business stakeholders

and sales managers I devised a sophisticated solution which

reliably provides the required forecasts. These include the ikelihood

that a farmer will arrive within a particular period, the amount

of crop they are likely to bring if they arrive, and the financial

product the farmer is most likely to select during contract negotiations.

My solution enabled a successful targeted marketing campaign, leading to

a notable 12% increase in closure rate.

For the insights such as likelihood to arrive and amount of crop

to bring I ultimately found that a statistical modeling approach,

as opposed to ML, was most effective. For the question of the

financial product they prefer I built a hierarchical classification

model. This first forecasts the most likely family of product they

prefer, and then once identified further refines the recommendation

by forecasting the most likely product within this family.

Generative AI

LLM Assisted Code Migration

Translating legacy code into newer systems, with updated syntax

or even a newer language, is a growing problem across most large

companies. Cargill is no exception. Migrating extremely important

systems written in archaic languages is difficult, time-consuming,

and extremely expensive. This project seeks to minimize this burden

by Leveraging state-of-the-art LLM modeling strategies.

One of the first things I investigated was whether we can

translate the code directly into the new language and system,

leaving the developer to briefly assess the new code via visual

inspection, run pre-existing robust unit tests, and address any

minor differences found. However, I quickly found that the

problem wouldn't capitulate this easily. In many cases the

integrations with the new system were different enough that

the LLM was not able to sufficiently understand the differences

and the developer was finding no significant benefits as they

had to check through every line regardless.

With this in mind I changed tactics and although I did still

provide this "possible" code translation, I added additional

insight to help the developer identify the portions of the

code most likely to need careful examination. To do this I

supplied a customized pseudocode which summarizes the original

code in a human-readable format, while explicitly indicating

the sections where it believes that integration changes are

most likely.

Using this even if the translation makes a mistake, the

developer doesn't need to search through every line to find

them. This is ongoing, but so far this hybrid approach has

worked very well and we are on-track to shave almost one-million

dollars from the estimated migration cost.